FRED API and pandas-datareader#

This section covers two powerful tools for accessing economic and financial data:

FRED API via the

fredapipackagepandas-datareader for accessing multiple data sources

What is FRED?#

The Federal Reserve Economic Data (FRED) is maintained by the Federal Reserve Bank of St. Louis. It contains over 800,000 economic time series from dozens of sources, including:

GDP and economic growth indicators

Inflation measures (CPI, PCE)

Interest rates and yield curves

Employment and labor market data

International economic data

Cryptocurrency prices

Getting Started with FRED#

To use the FRED API, you need to:

Create a FRED account

Request an API key

Store your key securely (never hardcode it!)

Install the package:

pip install fredapi

Set-up#

# Core packages

from fredapi import Fred

import pandas_datareader as pdr

import os

from dotenv import load_dotenv

import numpy as np

import pandas as pd

import datetime as dt

import matplotlib as mpl

import matplotlib.pyplot as plt

# Include this to have plots show up in your Jupyter notebook.

%matplotlib inline

---------------------------------------------------------------------------

TypeError Traceback (most recent call last)

Cell In[1], line 3

1 # Core packages

2 from fredapi import Fred

----> 3 import pandas_datareader as pdr

4 import os

5 from dotenv import load_dotenv

File ~/Documents/fin-data-analysis-text/.venv/lib/python3.12/site-packages/pandas_datareader/__init__.py:5

2 import sys

4 from ._version import get_versions

----> 5 from .data import (

6 DataReader,

7 Options,

8 get_components_yahoo,

9 get_dailysummary_iex,

10 get_data_alphavantage,

11 get_data_enigma,

12 get_data_famafrench,

13 get_data_fred,

14 get_data_moex,

15 get_data_quandl,

16 get_data_stooq,

17 get_data_tiingo,

18 get_data_yahoo,

19 get_data_yahoo_actions,

20 get_iex_book,

21 get_iex_data_tiingo,

22 get_iex_symbols,

23 get_last_iex,

24 get_markets_iex,

25 get_nasdaq_symbols,

26 get_quote_yahoo,

27 get_recent_iex,

28 get_records_iex,

29 get_summary_iex,

30 get_tops_iex,

31 )

33 PKG = os.path.dirname(__file__)

35 __version__ = get_versions()["version"]

File ~/Documents/fin-data-analysis-text/.venv/lib/python3.12/site-packages/pandas_datareader/data.py:273

246 """

247 Returns an array of dictionaries with depth of book data from IEX for up to

248 10 securities at a time. Returns a dictionary of the bid and ask books.

(...) 268 DataFrame

269 """

270 return IEXDeep(*args, **kwargs).read()

--> 273 @deprecate_kwarg("access_key", "api_key")

274 def DataReader(

275 name,

276 data_source=None,

277 start=None,

278 end=None,

279 retry_count=3,

280 pause=0.1,

281 session=None,

282 api_key=None,

283 ):

284 """

285 Imports data from a number of online sources.

286

(...) 330 ff = DataReader("F-F_ST_Reversal_Factor", "famafrench")

331 """

332 expected_source = [

333 "yahoo",

334 "iex",

(...) 362 "naver",

363 ]

TypeError: deprecate_kwarg() missing 1 required positional argument: 'new_arg_name'

# Load API keys from .env file

load_dotenv()

# Retrieve API keys

FRED_API_KEY = os.getenv('FRED_API_KEY')

# Initialize FRED API

fred = Fred(api_key=FRED_API_KEY)

Secure API Key Storage#

Here’s the wrong way to use your API key:

# DON'T DO THIS!

fred = Fred(api_key='your_api_key_here')

If you push this code to GitHub, your key is exposed to the world!

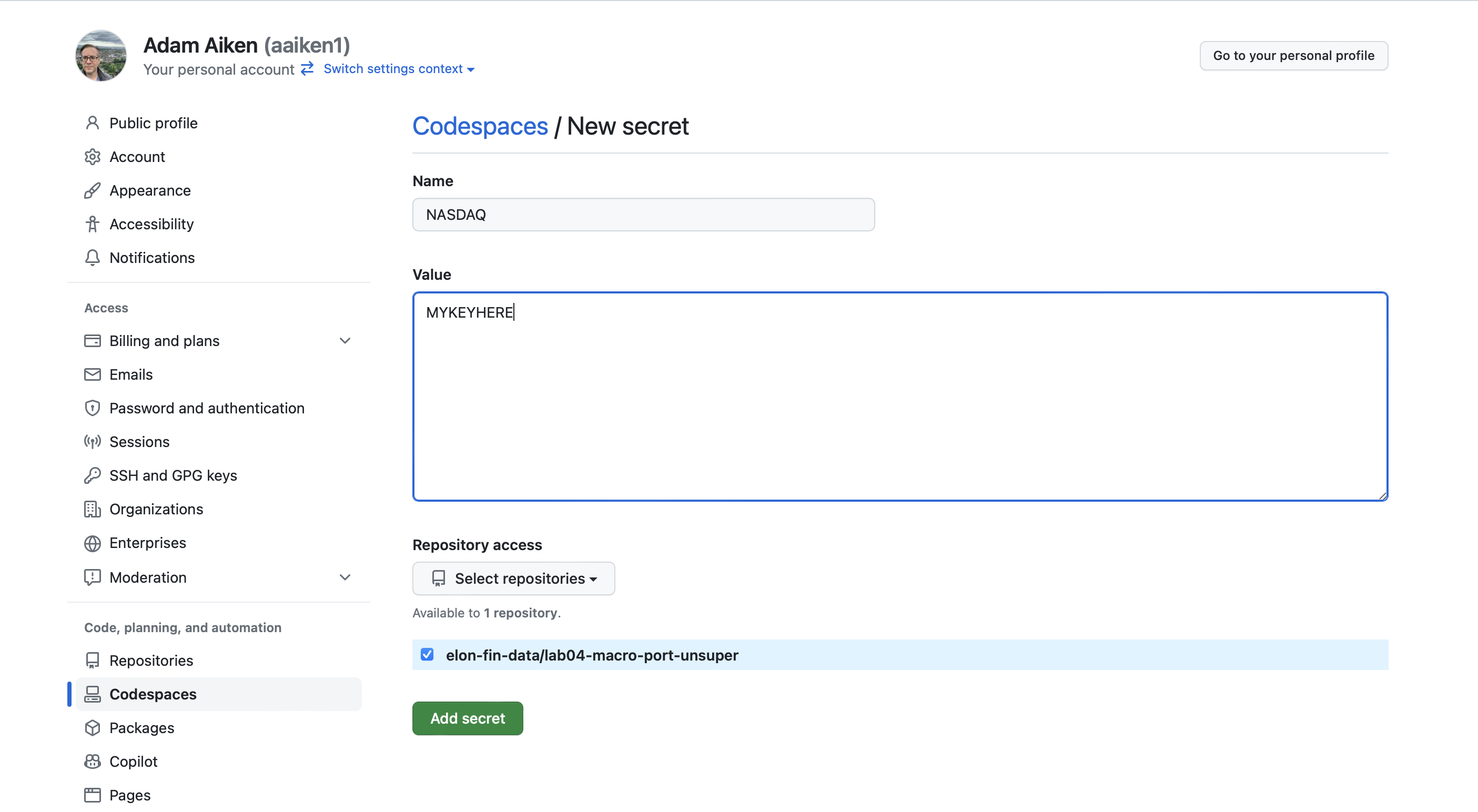

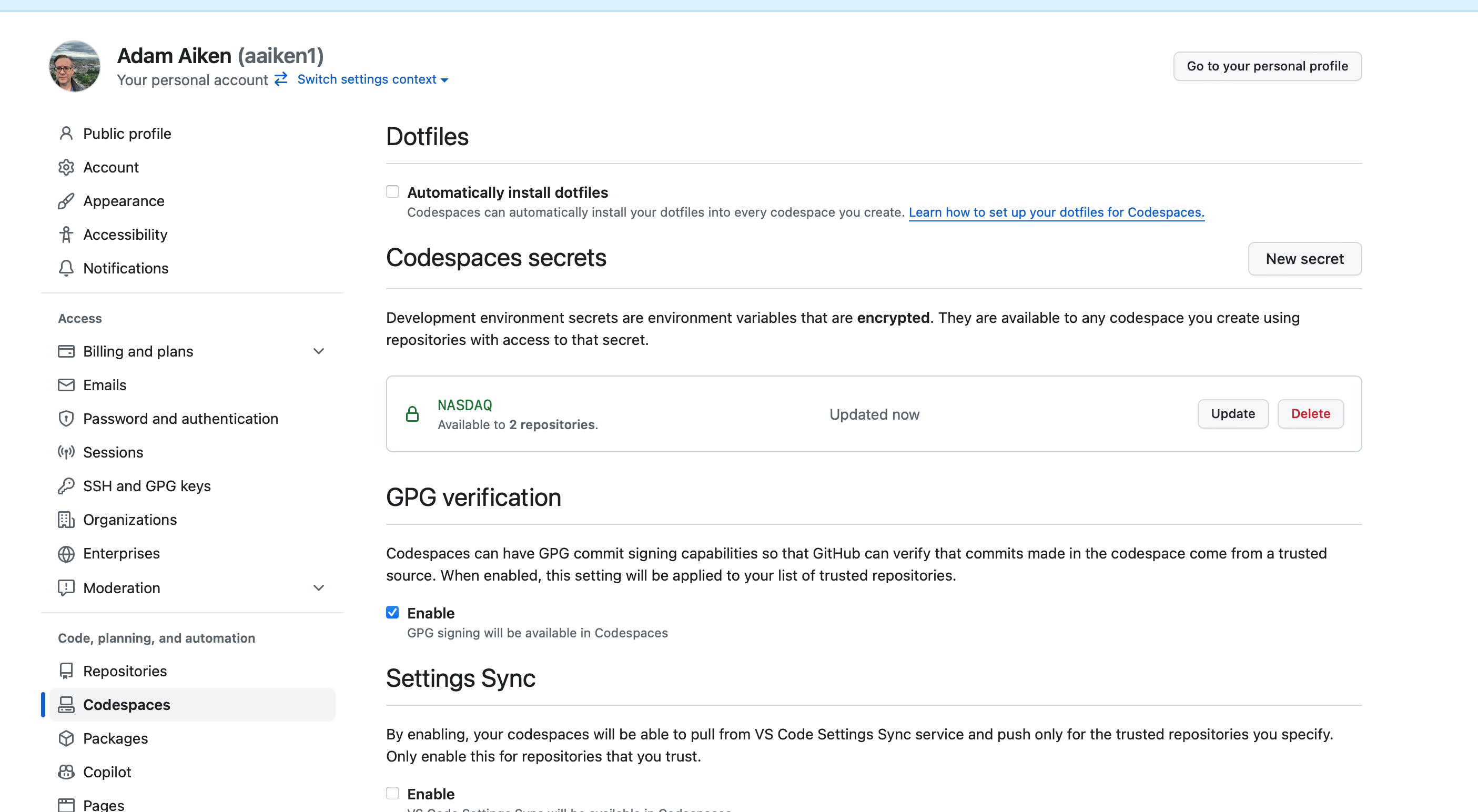

Using GitHub Secrets (Recommended for Codespaces)#

If you’re using GitHub Codespaces:

Go to your main GitHub page at GitHub.com

Click your profile image (upper-right) → Settings

Click Codespaces under “Code, planning, and automation”

Click New Secret under “Codespaces Secrets”

Name it (e.g.,

FRED) and paste your API keySelect the repo(s) to associate with this secret

Fig. 37 GitHub Codespaces secrets settings.#

Fig. 38 Adding a new secret.#

Then access it in your code:

# Secure way (Recommended)

from fredapi import Fred

import os

FRED_API_KEY = os.environ.get('FRED')

fred = Fred(api_key=FRED_API_KEY)

Note

If you add a secret while your Codespace is running, you’ll need to restart it for the secret to be available.

FRED Example: Bitcoin Data#

Let’s pull Bitcoin price data from FRED. You can find the series here.

When you find data on FRED, note the series code - that’s how you’ll request it via the API.

btc = fred.get_series('CBBTCUSD')

btc.tail()

2026-01-23 89365.99

2026-01-24 89155.13

2026-01-25 86978.89

2026-01-26 88136.48

2026-01-27 89296.00

dtype: float64

That’s just a plain Series, not a DataFrame. Let’s convert it and clean it up.

btc = btc.to_frame(name='btc')

btc = btc.rename_axis('date')

btc

| btc | |

|---|---|

| date | |

| 2014-12-01 | 370.00 |

| 2014-12-02 | 378.00 |

| 2014-12-03 | 378.00 |

| 2014-12-04 | 377.10 |

| 2014-12-05 | NaN |

| ... | ... |

| 2026-01-23 | 89365.99 |

| 2026-01-24 | 89155.13 |

| 2026-01-25 | 86978.89 |

| 2026-01-26 | 88136.48 |

| 2026-01-27 | 89296.00 |

4076 rows × 1 columns

# Drop missing values

btc = btc.dropna()

# Calculate returns

btc['ret'] = btc['btc'].pct_change()

/var/folders/kx/y8vj3n6n5kq_d74vj24jsnh40000gn/T/ipykernel_84807/1503532820.py:2: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

btc['ret'] = btc['btc'].pct_change()

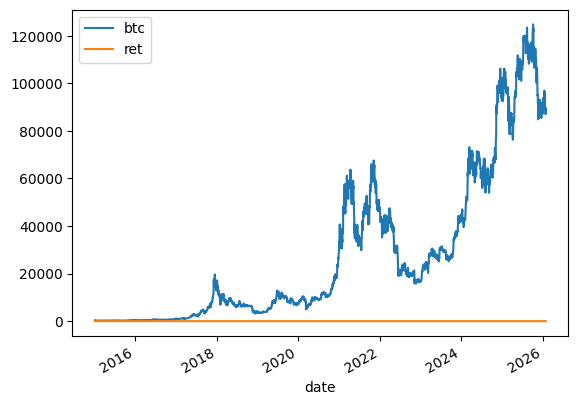

btc = btc.loc['2015-01-01':, ['btc', 'ret']]

btc.plot()

<Axes: xlabel='date'>

That’s not a very good graph - the returns and price levels are in different units. Let’s format the average return nicely:

print(f'Average return: {100 * btc.ret.mean():.2f}%')

Average return: 0.21%

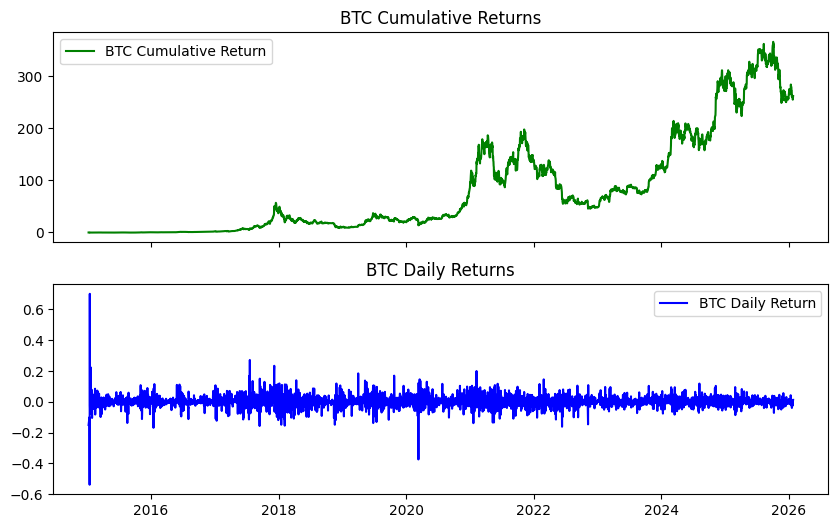

Visualizing Cumulative Returns#

Let’s create a cumulative return chart and daily return chart, stacked on top of each other.

btc['ret_g'] = btc.ret.add(1) # gross return

btc['ret_c'] = btc.ret_g.cumprod().sub(1) # cumulative return

btc

| btc | ret | ret_g | ret_c | |

|---|---|---|---|---|

| date | ||||

| 2015-01-08 | 288.99 | -0.150029 | 0.849971 | -0.150029 |

| 2015-01-13 | 260.00 | -0.100315 | 0.899685 | -0.235294 |

| 2015-01-14 | 120.00 | -0.538462 | 0.461538 | -0.647059 |

| 2015-01-15 | 204.22 | 0.701833 | 1.701833 | -0.399353 |

| 2015-01-16 | 199.46 | -0.023308 | 0.976692 | -0.413353 |

| ... | ... | ... | ... | ... |

| 2026-01-23 | 89365.99 | -0.001746 | 0.998254 | 261.841147 |

| 2026-01-24 | 89155.13 | -0.002360 | 0.997640 | 261.220971 |

| 2026-01-25 | 86978.89 | -0.024410 | 0.975590 | 254.820265 |

| 2026-01-26 | 88136.48 | 0.013309 | 1.013309 | 258.224941 |

| 2026-01-27 | 89296.00 | 0.013156 | 1.013156 | 261.635294 |

4032 rows × 4 columns

fig, axs = plt.subplots(2, 1, sharex=True, sharey=False, figsize=(10, 6))

axs[0].plot(btc.ret_c, 'g', label='BTC Cumulative Return')

axs[1].plot(btc.ret, 'b', label='BTC Daily Return')

axs[0].set_title('BTC Cumulative Returns')

axs[1].set_title('BTC Daily Returns')

axs[0].legend()

axs[1].legend();

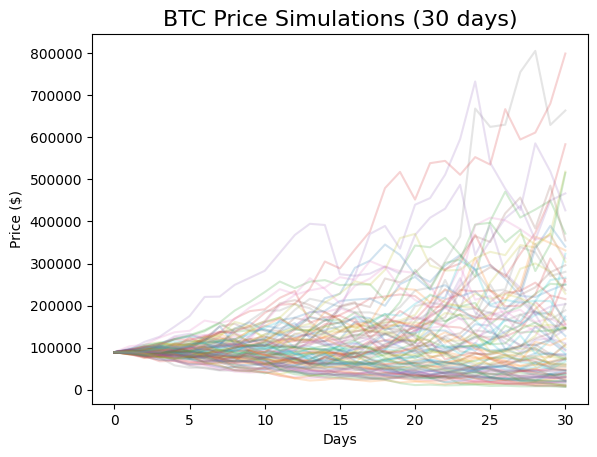

A Bitcoin Simulation #

Let’s put together some ideas, write a function, and run a simulation using Geometric Brownian Motion (GBM).

What is GBM?#

GBM is a stochastic differential equation commonly used to model asset prices:

This says the change in stock price has two components:

A drift (\(\mu\)): the average increase over time

A shock (\(\sigma dW_t\)): random noise scaled by volatility

The solution gives us the price at any time \(t\):

Note

We’re not predicting here. We’re capturing basic dynamics of how an asset moves and seeing what’s possible in the future.

# Simulation parameters

T = 30 # Time horizon (days)

N = 30 # Number of time steps

S_0 = btc.btc[-1] # Initial BTC price

N_SIM = 100 # Number of simulations

mu = btc.ret.mean()

sigma = btc.ret.std()

/var/folders/kx/y8vj3n6n5kq_d74vj24jsnh40000gn/T/ipykernel_84807/3399872927.py:4: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

S_0 = btc.btc[-1] # Initial BTC price

def simulate_gbm(s_0, mu, sigma, n_sims, T, N):

"""Simulate asset prices using Geometric Brownian Motion."""

dt = T / N # One day

dW = np.random.normal(scale=np.sqrt(dt), size=(n_sims, N)) # Random shocks

W = np.cumsum(dW, axis=1) # Cumulative sum of shocks

time_step = np.linspace(dt, T, N)

time_steps = np.broadcast_to(time_step, (n_sims, N))

S_t = s_0 * np.exp((mu - 0.5 * sigma ** 2) * time_steps + sigma * np.sqrt(time_steps) * W)

S_t = np.insert(S_t, 0, s_0, axis=1)

return S_t

# Run the simulation

gbm_simulations = simulate_gbm(S_0, mu, sigma, N_SIM, T, N)

# Plot all simulations

gbm_simulations_df = pd.DataFrame(np.transpose(gbm_simulations))

ax = gbm_simulations_df.plot(alpha=0.2, legend=False)

ax.set_title('BTC Price Simulations (30 days)', fontsize=16)

ax.set_xlabel('Days')

ax.set_ylabel('Price ($)');

The y-axis has a wide range because some extreme values are possible given Bitcoin’s high volatility.

pandas-datareader#

The pandas-datareader package provides a unified interface to multiple data sources, including FRED.

Install it:

pip install pandas-datareader

Note

Different data sources might require API keys. Always read the documentation.

# Example: Pull GDP data from FRED using pandas-datareader

start = dt.datetime(2010, 1, 1)

end = dt.datetime(2023, 1, 27)

gdp = pdr.DataReader('GDP', 'fred', start, end)

gdp.head()

| GDP | |

|---|---|

| DATE | |

| 2010-01-01 | 14764.610 |

| 2010-04-01 | 14980.193 |

| 2010-07-01 | 15141.607 |

| 2010-10-01 | 15309.474 |

| 2011-01-01 | 15351.448 |

The advantage of pandas-datareader is the consistent interface across different data sources. Check the documentation for all available sources.