Logit models#

Linear regressions ((ordinary least squares, or OLS)) tells us about the association between a dependent, or Y variable, and a set of independent, or X variables. Regression does not tell us anything about one variable causing another or if the correlations we find have any real meaning. It is simply a statistical technique for finding a linear relationship between two variables. The meaning of that relationship is up to us and the ideas that we are working with. In finance, we usually have an economic model in mind, such as the CAPM, that gives meaning to the relationship that we find.

A logit regression does something similar, except that it was developed for when our dependent variable is binary, a Yes or No. Logistic regression is a regression model where the response variable Y is categorical, as opposed to continuous. These types of models are used for classification. Why do we need a new model? We want a model that can give us probabilities for an event. Regular regression isn’t set up to do this

We will look at a type of data that is commonly used with logit models in finance: credit card default data. This data set has a binary outcome. Did the credit card user default? Yes or No? 1 or 0?

I start with some data from a DataCamp module on credit risk analysis. I then work the examples from the Hull textbook, Chapters 3 and 10.

My first set of notes below are focused on interpreting coefficients in the model. The Hull text is focused on the predictive outcome. cd ..

We’ll start with some usual set-up, bringing the data in, and taking a peak.

# import packages

import warnings

warnings.filterwarnings('ignore')

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

import statsmodels.api as sm

import statsmodels.formula.api as smf

# Include this to have plots show up in your Jupyter notebook.

%matplotlib inline

# For the Hull logit

from sklearn.linear_model import LogisticRegression

from sklearn.metrics import accuracy_score, recall_score, precision_score, f1_score

from sklearn.metrics import confusion_matrix, classification_report, roc_curve, roc_auc_score

from sklearn.metrics import precision_recall_curve, auc, average_precision_score

Let’s bring in the credit card default data first.

loans = pd.read_csv('https://raw.githubusercontent.com/aaiken1/fin-data-analysis-python/main/data/loan_data.csv', index_col=0)

There are no dates in this data, so no dates to parse. The first column is simply the row number, so I’ll make that my index.

Cleaning our data#

Let’s get started by just looking at what we have.

loans.info()

<class 'pandas.core.frame.DataFrame'>

Index: 29092 entries, 1 to 29092

Data columns (total 8 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 loan_status 29092 non-null int64

1 loan_amnt 29092 non-null int64

2 int_rate 26316 non-null float64

3 grade 29092 non-null object

4 emp_length 28283 non-null float64

5 home_ownership 29092 non-null object

6 annual_inc 29092 non-null float64

7 age 29092 non-null int64

dtypes: float64(3), int64(3), object(2)

memory usage: 2.0+ MB

We are interested in explaining the loan_status variable. In this data set, loan_status = 1 means that the credit card holder has defaulted on their loan. What explains the defaults? The loan amount? Their income? Employment status? Their age?

loans.describe()

| loan_status | loan_amnt | int_rate | emp_length | annual_inc | age | |

|---|---|---|---|---|---|---|

| count | 29092.000000 | 29092.000000 | 26316.000000 | 28283.000000 | 2.909200e+04 | 29092.000000 |

| mean | 0.110924 | 9593.505947 | 11.004567 | 6.145282 | 6.716883e+04 | 27.702117 |

| std | 0.314043 | 6323.416157 | 3.239012 | 6.677632 | 6.360652e+04 | 6.231927 |

| min | 0.000000 | 500.000000 | 5.420000 | 0.000000 | 4.000000e+03 | 20.000000 |

| 25% | 0.000000 | 5000.000000 | 7.900000 | 2.000000 | 4.000000e+04 | 23.000000 |

| 50% | 0.000000 | 8000.000000 | 10.990000 | 4.000000 | 5.642400e+04 | 26.000000 |

| 75% | 0.000000 | 12250.000000 | 13.470000 | 8.000000 | 8.000000e+04 | 30.000000 |

| max | 1.000000 | 35000.000000 | 23.220000 | 62.000000 | 6.000000e+06 | 144.000000 |

Note the units. Loan amount appears to be in dollars. The max of $35,000 reflects the general limit on credit card borrowing - these aren’t mortgages. Interest rate is in percents. The median credit card rate in this sample is 10.99%. Employment length is in years, as is age. Annual income is in dollars. Note the max values for annual_inc and age. Seems odd.

Home ownership and grade do not appear, since they are text variables, not numeric. Grade is some kind of overall measure of loan quality.

Let’s convert the two object variables to categorical variables so that we can deal with them. This code puts all of the object columns into a list and then loops through that list to change those columsn to type category.

list_str_obj_cols = loans.columns[loans.dtypes == 'object'].tolist()

for str_obj_col in list_str_obj_cols:

loans[str_obj_col] = loans[str_obj_col].astype('category')

loans.dtypes

loan_status int64

loan_amnt int64

int_rate float64

grade category

emp_length float64

home_ownership category

annual_inc float64

age int64

dtype: object

Looks good! I’m now going to add include='all' to describe to give more information about these categorical variables.

loans.describe(include='all')

| loan_status | loan_amnt | int_rate | grade | emp_length | home_ownership | annual_inc | age | |

|---|---|---|---|---|---|---|---|---|

| count | 29092.000000 | 29092.000000 | 26316.000000 | 29092 | 28283.000000 | 29092 | 2.909200e+04 | 29092.000000 |

| unique | NaN | NaN | NaN | 7 | NaN | 4 | NaN | NaN |

| top | NaN | NaN | NaN | A | NaN | RENT | NaN | NaN |

| freq | NaN | NaN | NaN | 9649 | NaN | 14692 | NaN | NaN |

| mean | 0.110924 | 9593.505947 | 11.004567 | NaN | 6.145282 | NaN | 6.716883e+04 | 27.702117 |

| std | 0.314043 | 6323.416157 | 3.239012 | NaN | 6.677632 | NaN | 6.360652e+04 | 6.231927 |

| min | 0.000000 | 500.000000 | 5.420000 | NaN | 0.000000 | NaN | 4.000000e+03 | 20.000000 |

| 25% | 0.000000 | 5000.000000 | 7.900000 | NaN | 2.000000 | NaN | 4.000000e+04 | 23.000000 |

| 50% | 0.000000 | 8000.000000 | 10.990000 | NaN | 4.000000 | NaN | 5.642400e+04 | 26.000000 |

| 75% | 0.000000 | 12250.000000 | 13.470000 | NaN | 8.000000 | NaN | 8.000000e+04 | 30.000000 |

| max | 1.000000 | 35000.000000 | 23.220000 | NaN | 62.000000 | NaN | 6.000000e+06 | 144.000000 |

This doesn’t show us all of the possible values, but at least we can see the number of values that aren’t missing, as well as a count of unique values. Let’s get a list of possible values for each categorical variable.

loans['grade'].value_counts()

grade

A 9649

B 9329

C 5748

D 3231

E 868

F 211

G 56

Name: count, dtype: int64

loans['home_ownership'].value_counts()

home_ownership

RENT 14692

MORTGAGE 12002

OWN 2301

OTHER 97

Name: count, dtype: int64

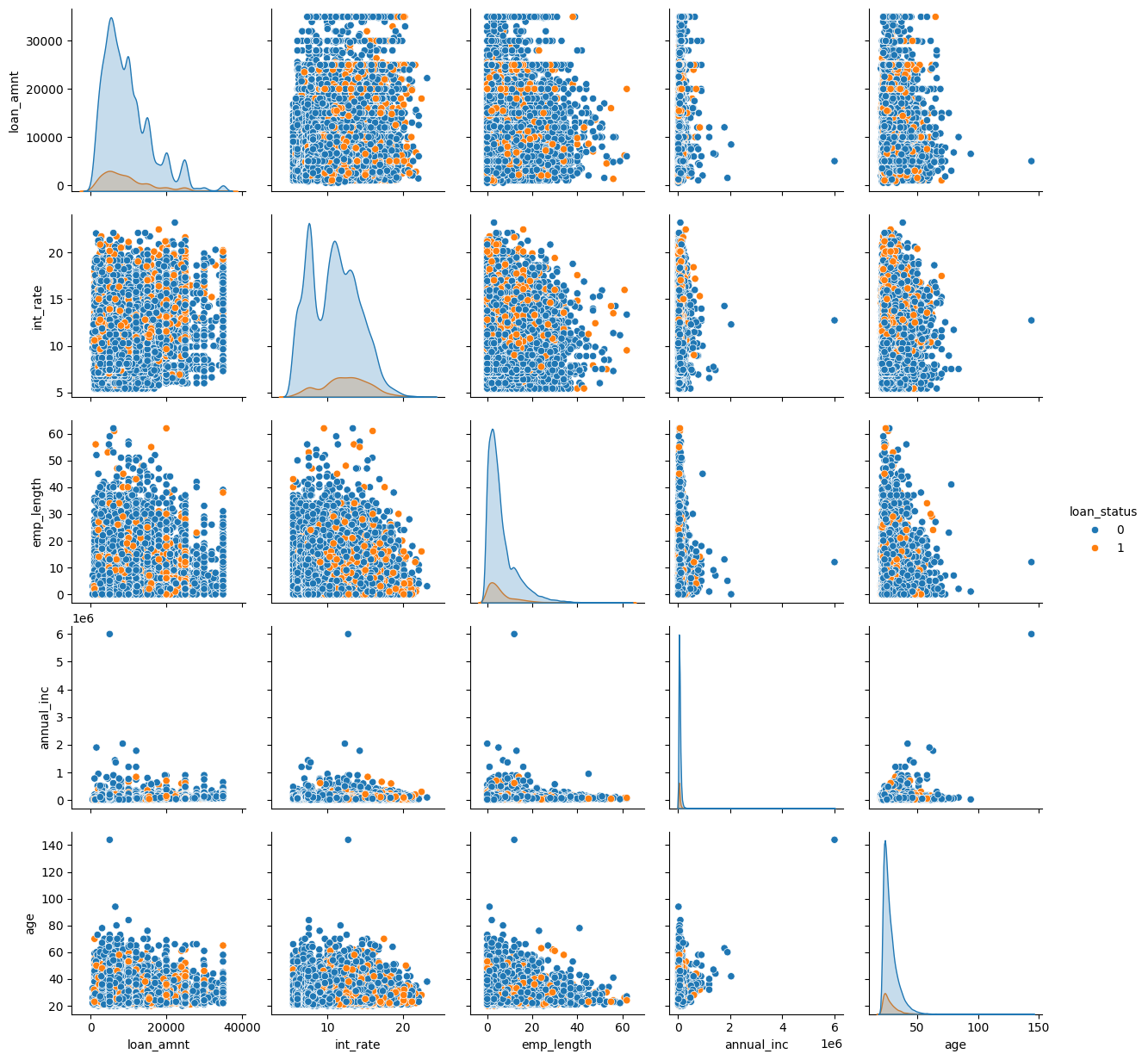

We can use sns.pairplot from the seaborn library to get a nice visualization of the relationships between our variables. The diagonal plots show the denisity plots for that one variable, but split between loan_status. The off-diagonal plots show the relationship between two of the explanatory (X) variables, but with each observation color-coded based on a third variable, their default status.

Orange means that the person has defaulted.

sns.pairplot(loans, hue='loan_status');

What jumps out to you? First, I see some outliers in age. Someone is over 140 years old in the data! We should drop that observation.

There’s also one individual with a really large annual income. We could also drop that one observation. Outlier observations can overly influence our regression results, though there are techniques for dealing with that.

We can also visually see some of the relationships. Look up and down the int_rate column. Generally, there are more orange dots when the interest rate is higher. Look at the second row, second column. The mean of the smaller density is to the right of the larger one. The smaller one has an orange border and shows the distribution of interest rates on the loans that defaulted.

Look at the third row, second column. There are more orange dots in the higher interest rate, shorter employment length part of the distribution. Look at the fifth row, second column. Loans that defaulted tended to be younger and with higher interest rates.

I am going to clean up two of the outliers - the one for annual income and the one for age. I’ll also drop any row with a missing value.

When done, I’ll re-check my data.

loans = loans[loans['annual_inc'] < 6000000]

loans = loans[loans['age'] < 144]

loans = loans.dropna()

loans.describe(include='all')

| loan_status | loan_amnt | int_rate | grade | emp_length | home_ownership | annual_inc | age | |

|---|---|---|---|---|---|---|---|---|

| count | 25570.000000 | 25570.000000 | 25570.000000 | 25570 | 25570.000000 | 25570 | 2.557000e+04 | 25570.000000 |

| unique | NaN | NaN | NaN | 7 | NaN | 4 | NaN | NaN |

| top | NaN | NaN | NaN | A | NaN | RENT | NaN | NaN |

| freq | NaN | NaN | NaN | 8412 | NaN | 13015 | NaN | NaN |

| mean | 0.109190 | 9655.154478 | 11.034409 | NaN | 6.127219 | NaN | 6.750489e+04 | 27.695190 |

| std | 0.311884 | 6324.540307 | 3.228964 | NaN | 6.653610 | NaN | 5.214082e+04 | 6.163362 |

| min | 0.000000 | 500.000000 | 5.420000 | NaN | 0.000000 | NaN | 4.000000e+03 | 20.000000 |

| 25% | 0.000000 | 5000.000000 | 7.900000 | NaN | 2.000000 | NaN | 4.000000e+04 | 23.000000 |

| 50% | 0.000000 | 8000.000000 | 10.990000 | NaN | 4.000000 | NaN | 5.700600e+04 | 26.000000 |

| 75% | 0.000000 | 12500.000000 | 13.480000 | NaN | 8.000000 | NaN | 8.000400e+04 | 30.000000 |

| max | 1.000000 | 35000.000000 | 23.220000 | NaN | 62.000000 | NaN | 2.039784e+06 | 84.000000 |

That seems better. Note that each variable now has the same count. Only rows with all of the information are included. This isn’t necessarily best practices when it comes to data. You want to know why your data are missing. You can sometimes fill in the missing data using a variety of methods, as well.

We can also use the basic pd.crosstabs function from pandas to look at variables across our categorical data.

pd.crosstab(loans['loan_status'], loans['home_ownership'])

| home_ownership | MORTGAGE | OTHER | OWN | RENT |

|---|---|---|---|---|

| loan_status | ||||

| 0 | 9506 | 69 | 1740 | 11463 |

| 1 | 1019 | 16 | 205 | 1552 |

We can normalize these counts as well, either over all values, by row, or by column.

pd.crosstab(loans['loan_status'], loans['home_ownership'], normalize = 'all')

| home_ownership | MORTGAGE | OTHER | OWN | RENT |

|---|---|---|---|---|

| loan_status | ||||

| 0 | 0.371764 | 0.002698 | 0.068048 | 0.448299 |

| 1 | 0.039851 | 0.000626 | 0.008017 | 0.060696 |

This tells us that about 6% of our sample are renters who defaulted. We can try normalizing by column, too.

pd.crosstab(loans['loan_status'], loans['home_ownership'], normalize = 'columns')

| home_ownership | MORTGAGE | OTHER | OWN | RENT |

|---|---|---|---|---|

| loan_status | ||||

| 0 | 0.903183 | 0.811765 | 0.894602 | 0.880753 |

| 1 | 0.096817 | 0.188235 | 0.105398 | 0.119247 |

Now, each column adds up to 1. 11.9% of all renters in the sample defaulted.

Finally, we can look at the margins. These add up values by row and column.

pd.crosstab(loans['loan_status'], loans['home_ownership'], normalize = 'all', margins = True)

| home_ownership | MORTGAGE | OTHER | OWN | RENT | All |

|---|---|---|---|---|---|

| loan_status | |||||

| 0 | 0.371764 | 0.002698 | 0.068048 | 0.448299 | 0.89081 |

| 1 | 0.039851 | 0.000626 | 0.008017 | 0.060696 | 0.10919 |

| All | 0.411615 | 0.003324 | 0.076066 | 0.508995 | 1.00000 |

So, 10.9% of the full sample defaulted on their loans. About 51% are the full sample are renters. And, about 6% of renters defaulted.

You can play around with the options to get the counts or percents that you want.

Linear regression with a binary outcome#

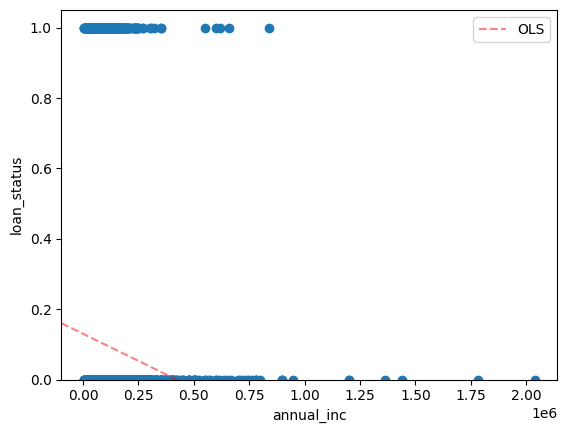

Now, let’s run a regular linear regression to see what the relationship between loan status (default = 1) and annual income is. We are going to use the statsmodel library.

results_ols = smf.ols("loan_status ~ annual_inc", data=loans).fit()

print(results_ols.summary())

OLS Regression Results

==============================================================================

Dep. Variable: loan_status R-squared: 0.003

Model: OLS Adj. R-squared: 0.003

Method: Least Squares F-statistic: 67.76

Date: Wed, 11 Mar 2026 Prob (F-statistic): 1.93e-16

Time: 15:04:27 Log-Likelihood: -6455.7

No. Observations: 25570 AIC: 1.292e+04

Df Residuals: 25568 BIC: 1.293e+04

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 0.1300 0.003 40.781 0.000 0.124 0.136

annual_inc -3.075e-07 3.74e-08 -8.232 0.000 -3.81e-07 -2.34e-07

==============================================================================

Omnibus: 12058.535 Durbin-Watson: 1.999

Prob(Omnibus): 0.000 Jarque-Bera (JB): 45854.058

Skew: 2.497 Prob(JB): 0.00

Kurtosis: 7.255 Cond. No. 1.40e+05

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.4e+05. This might indicate that there are

strong multicollinearity or other numerical problems.

fig, ax = plt.subplots()

ax.scatter(loans["annual_inc"], loans["loan_status"])

sm.graphics.abline_plot(model_results=results_ols, ax=ax, color="red", label="OLS", alpha=0.5, ls="--")

ax.legend()

ax.set_xlabel("annual_inc")

ax.set_ylabel("loan_status")

ax.set_ylim(0, None)

plt.show()

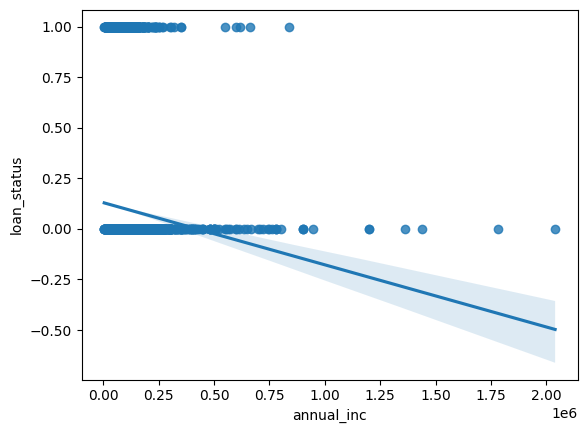

Well, that sure looks strange! Linear regression shows loan status going negative!

Let’s do the same thing with seaborn. It’s very easy to add a regression line, like you would in Excel.

sns.regplot(x="annual_inc", y="loan_status", data=loans);

Yeah, that really doesn’t make sense. seaborn lets us also add the fit from a logistic regression, though.

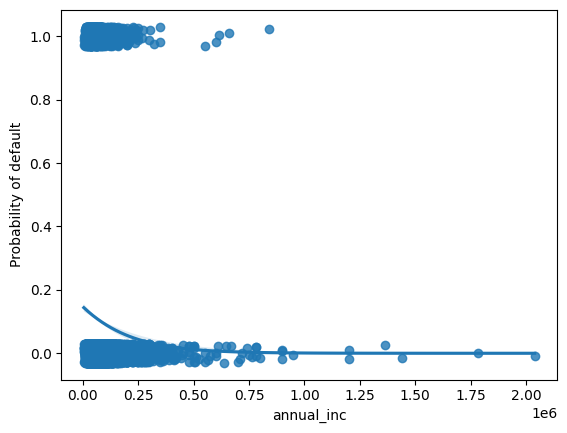

sns.regplot(x="annual_inc", y="loan_status", data=loans, logistic=True, y_jitter=.03)

plt.ylabel("Probability of default");

OK, that still looks a bit strange, but at least loan status is never below 0!

Categorical variables, again#

We’ll add the other variables to the regression, for completeness. To do this, though, I’m going to take my categorical variables and create new dummy or indicator variables. This will take the categories and create new columns. These new columns will take the value of 1 or 0, depending on whether or not that observation is in that category.

I’ll use pd.get_dummies to do this. I then concatenate, or combine, this new set of indicator variables to my original data. The prefix= helps me name the new variables.

loans= pd.concat((loans, pd.get_dummies(loans['grade'], prefix='loan_grade')), axis = 1)

loans= pd.concat((loans, pd.get_dummies(loans['home_ownership'], prefix='home')), axis = 1)

You don’t have to create the numeric indicator variables for the regression models. However, when dealing with indicators, you need to drop one of them from the model. For example, for home ownership, you can’t include home_mortgage, home_rent, home_own, and home_other. You always have to drop one category, or the regression won’t work. This is because the four variables together are perfectly multicollinear. See Chapter 3 of the Hull text for more.

I find it easier sometimes to manipulate the model when I have a distinct indicator variable for my categorical variables. You can also use the treatment= option when specifying a variable as categorical directly in the model.

For example, let me run the OLS model with home_ownership included as a categorical variable.

results_ols = smf.ols("loan_status ~ annual_inc + home_ownership", data=loans).fit()

print(results_ols.summary())

OLS Regression Results

==============================================================================

Dep. Variable: loan_status R-squared: 0.003

Model: OLS Adj. R-squared: 0.003

Method: Least Squares F-statistic: 21.92

Date: Wed, 11 Mar 2026 Prob (F-statistic): 4.44e-18

Time: 15:04:42 Log-Likelihood: -6445.8

No. Observations: 25570 AIC: 1.290e+04

Df Residuals: 25565 BIC: 1.294e+04

Df Model: 4

Covariance Type: nonrobust

===========================================================================================

coef std err t P>|t| [0.025 0.975]

-------------------------------------------------------------------------------------------

Intercept 0.1196 0.004 27.261 0.000 0.111 0.128

home_ownership[T.OTHER] 0.0890 0.034 2.625 0.009 0.023 0.155

home_ownership[T.OWN] 0.0023 0.008 0.292 0.770 -0.013 0.017

home_ownership[T.RENT] 0.0153 0.004 3.649 0.000 0.007 0.024

annual_inc -2.766e-07 3.85e-08 -7.190 0.000 -3.52e-07 -2.01e-07

==============================================================================

Omnibus: 12043.575 Durbin-Watson: 2.000

Prob(Omnibus): 0.000 Jarque-Bera (JB): 45736.120

Skew: 2.494 Prob(JB): 0.00

Kurtosis: 7.249 Cond. No. 1.49e+06

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.49e+06. This might indicate that there are

strong multicollinearity or other numerical problems.

That worked just fine. But, notice how home_ownership[T.Mortgage] is missing? The model automatically dropped it. So, the other home_ownership values are relative to having a mortgage. This may be just fine, of course! We can interpret the coefficient for renting, for example, as meaning that renters are more likely to default than those that have a mortgage.

Here, I’ll use my indicator variables and run a fully-specified model.

loans.info()

<class 'pandas.core.frame.DataFrame'>

Index: 25570 entries, 1 to 29091

Data columns (total 19 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 loan_status 25570 non-null int64

1 loan_amnt 25570 non-null int64

2 int_rate 25570 non-null float64

3 grade 25570 non-null category

4 emp_length 25570 non-null float64

5 home_ownership 25570 non-null category

6 annual_inc 25570 non-null float64

7 age 25570 non-null int64

8 loan_grade_A 25570 non-null bool

9 loan_grade_B 25570 non-null bool

10 loan_grade_C 25570 non-null bool

11 loan_grade_D 25570 non-null bool

12 loan_grade_E 25570 non-null bool

13 loan_grade_F 25570 non-null bool

14 loan_grade_G 25570 non-null bool

15 home_MORTGAGE 25570 non-null bool

16 home_OTHER 25570 non-null bool

17 home_OWN 25570 non-null bool

18 home_RENT 25570 non-null bool

dtypes: bool(11), category(2), float64(3), int64(3)

memory usage: 1.7 MB

I will exclude the top rated A loan indicator and the indicator for renting. Therefore, the other indicator variables will be relative to the excluded one.

results_ols = smf.ols("loan_status ~ loan_amnt + int_rate + emp_length + annual_inc + age + loan_grade_B + loan_grade_C + loan_grade_D + loan_grade_E + loan_grade_F + loan_grade_G + home_MORTGAGE + home_OWN + home_OTHER", data=loans).fit()

print(results_ols.summary())

OLS Regression Results

==============================================================================

Dep. Variable: loan_status R-squared: 0.028

Model: OLS Adj. R-squared: 0.028

Method: Least Squares F-statistic: 52.76

Date: Wed, 11 Mar 2026 Prob (F-statistic): 2.32e-146

Time: 15:04:42 Log-Likelihood: -6125.3

No. Observations: 25570 AIC: 1.228e+04

Df Residuals: 25555 BIC: 1.240e+04

Df Model: 14

Covariance Type: nonrobust

=========================================================================================

coef std err t P>|t| [0.025 0.975]

-----------------------------------------------------------------------------------------

Intercept 0.0348 0.017 2.033 0.042 0.001 0.068

loan_grade_B[T.True] 0.0178 0.008 2.107 0.035 0.001 0.034

loan_grade_C[T.True] 0.0372 0.013 2.893 0.004 0.012 0.062

loan_grade_D[T.True] 0.0565 0.017 3.397 0.001 0.024 0.089

loan_grade_E[T.True] 0.0724 0.022 3.337 0.001 0.030 0.115

loan_grade_F[T.True] 0.1421 0.031 4.515 0.000 0.080 0.204

loan_grade_G[T.True] 0.2082 0.049 4.239 0.000 0.112 0.304

home_MORTGAGE[T.True] -0.0019 0.004 -0.435 0.663 -0.010 0.007

home_OWN[T.True] -0.0061 0.008 -0.819 0.413 -0.021 0.009

home_OTHER[T.True] 0.0674 0.033 2.014 0.044 0.002 0.133

loan_amnt -7.349e-07 3.29e-07 -2.236 0.025 -1.38e-06 -9.07e-08

int_rate 0.0083 0.002 4.368 0.000 0.005 0.012

emp_length 0.0006 0.000 1.868 0.062 -2.76e-05 0.001

annual_inc -3.002e-07 4.04e-08 -7.435 0.000 -3.79e-07 -2.21e-07

age -0.0006 0.000 -1.808 0.071 -0.001 4.81e-05

==============================================================================

Omnibus: 11579.427 Durbin-Watson: 2.001

Prob(Omnibus): 0.000 Jarque-Bera (JB): 42088.653

Skew: 2.402 Prob(JB): 0.00

Kurtosis: 7.054 Cond. No. 2.47e+06

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 2.47e+06. This might indicate that there are

strong multicollinearity or other numerical problems.

The interpretation of the signs on the coefficients is relatively straightforward. Larger credit card loans are less likely to default. Why? Lending is endogenous - it is chosen by the credit card company. They are more likely to allow larger balances for people less likely to default, all other things equal. Similarily, higher interest rates are related to more defaults. Larger annual incomes are associated with a smaller default rate. Lower loan grades, relative to A, are associated with more defaults. Finally, mortgage vs. renting doesn’t seem to be that different, once you include all of these other variables.

Logit models#

OK, so let’s look at a logit model. We can look at the signs of the coefficients from the OLS model, but we can’t really interpret much else. Those coefficients are not probabilities.

The true probability of defaulting must fall between 0 and 1. A logit function, show below, will satisfy this requirement.

The left-hand side is the probability that Y = 1, or, in our case, that a loan is in default, conditional on the X variables, or the variables that we are using to predict loan status. The right-hand side is the function that links our X variables to the probability that Y = 1.

We will use smf.logit to estimate our logit model. This is an example of using a generalized linear model (GLM), a class of models that includes logistic regression. You will also see logits described as binomial model.

In the background, GLM uses maximum likelihood to fit the model. The basic intuition behind using maximum likelihood to fit a logistic regression model is as follows:

We seek estimates for \(\beta_0\) an \(\beta_1\) that get us a predicted probability of default for each individual, \(p(x_i)\), that corresponds as closely as possible to the individual’s actual observed default status. In other words, we plug in beta estimates until we get numbers “close” to 1 for those that default and “close” to zero for those that do not. This is done using what is called a liklihood function.

Ordinary least squares regression (OLS) actually works in a similar manner, where betas are chosen to minimize the sum of squared residuals (errors).

Essentially, we pick a model that we think can explain our data. This could be OLS, logit, or something else. Then, we find the parameters to plug into that model that give us the best possible predicted values based on minimizing some kind of error function.

Let’s look at a logit with a discrete variable and a continuous X variable separately, in order to better understand how to interpret the output.

Logit with a discrete variable#

We can start simply, again. This time, I’m going to just use the indicator for whether or not the person rents.

results_logit = smf.logit("loan_status ~ home_RENT", data = loans).fit()

print(results_logit.summary())

Optimization terminated successfully.

Current function value: 0.344279

Iterations 6

Logit Regression Results

==============================================================================

Dep. Variable: loan_status No. Observations: 25570

Model: Logit Df Residuals: 25568

Method: MLE Df Model: 1

Date: Wed, 11 Mar 2026 Pseudo R-squ.: 0.001567

Time: 15:04:42 Log-Likelihood: -8803.2

converged: True LL-Null: -8817.0

Covariance Type: nonrobust LLR p-value: 1.473e-07

=====================================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------------

Intercept -2.2110 0.030 -73.913 0.000 -2.270 -2.152

home_RENT[T.True] 0.2114 0.040 5.243 0.000 0.132 0.290

=====================================================================================

We didn’t include renting in the linear model above, as it was the omitted indicator. But, here we can see that renting is associated with higher probability of default relative to all of the other possibilities and when not including any other variables in the model.

Also note that we don’t have t-statistics. With logit, you can z-scores. You can look at the p-values to see how you should interpret the score. The hypothesis is the same as in linear regression: can we reject the null hypothesis that this coefficient is zero?

The output from the logit regression is still hard to interpret, though. What does the coefficient on home_RENT of 0.2114 mean? This is a log odds ratio. Let’s convert this to an odds ratio, which is easier to think about.

An odds ratio is defined as:

where p = probability of the event happening. So, an 80% chance of happening = .8/.2 = 4:1 odds. 1:1 odds is a 50/50 chance. The logit model gives us the log of this number. So, we can use the inverse of the log, the natural number e, to “undo” the log and get us the odds.

odds_ratios = pd.DataFrame(

{

"OR": results_logit.params,

"Lower CI": results_logit.conf_int()[0],

"Upper CI": results_logit.conf_int()[1],

}

)

odds_ratios = np.exp(odds_ratios)

print(odds_ratios)

OR Lower CI Upper CI

Intercept 0.109589 0.103349 0.116206

home_RENT[T.True] 1.235453 1.141559 1.337070

What do these numbers mean? If someone rents, this increases the odds of default by about 1.24 versus all other options.

For more about interpreting odds, see here.

Odds ratios are not probabilities. Let’s calculate the change in the probability of default as you from 0 to 1 for home_ownership_RENT. The .get_margeff function finds marginal effects and let’s us move from odds ratios to probabilities.

Things get a bit complicated here. We have to find the marginal effect at some point, like the mean of the variable. This is like in economics, when you find price elasticity. I’m specifying that I have a dummy variable that I want to change and that I want the proportional change in loan_status for a change in home_RENT. This is the eydx specification.

p_marg_effect = results_logit.get_margeff(at='mean', method="eydx", dummy=True)

p_marg_effect.summary()

| Dep. Variable: | loan_status |

|---|---|

| Method: | eydx |

| At: | mean |

| d(lny)/dx | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| home_RENT[T.True] | 0.1884 | 0.036 | 5.238 | 0.000 | 0.118 | 0.259 |

You can interpret this as “going from not renting to renting is associated with an 18.84% increase loan_status.” You can also specify dydx, which is the default.

p_marg_effect = results_logit.get_margeff(at='mean', method="dydx", dummy=True)

p_marg_effect.summary()

| Dep. Variable: | loan_status |

|---|---|

| Method: | dydx |

| At: | mean |

| dy/dx | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| home_RENT[T.True] | 0.0205 | 0.004 | 5.260 | 0.000 | 0.013 | 0.028 |

You can interpret this as “going from not renting to renting is associated with an 0.0205 increase in loan_status from the mean of loan_status.”

Logit with a continuous variable#

We can also look at a continuous variable, like annual income.

results_logit = smf.logit("loan_status ~ annual_inc", data = loans).fit()

print(results_logit.summary())

Optimization terminated successfully.

Current function value: 0.342899

Iterations 7

Logit Regression Results

==============================================================================

Dep. Variable: loan_status No. Observations: 25570

Model: Logit Df Residuals: 25568

Method: MLE Df Model: 1

Date: Wed, 11 Mar 2026 Pseudo R-squ.: 0.005569

Time: 15:04:42 Log-Likelihood: -8767.9

converged: True LL-Null: -8817.0

Covariance Type: nonrobust LLR p-value: 3.765e-23

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -1.7618 0.041 -43.111 0.000 -1.842 -1.682

annual_inc -5.309e-06 5.89e-07 -9.014 0.000 -6.46e-06 -4.15e-06

==============================================================================

Let’s find our odds ratio for annual income. However, if we do that math exactly like above, we’ll find the incremental odds change for a dollar more in annual income. That’s going to be small! However, it is easy to change the increment for our continuous variable.

increment = 10000

odds_ratios = pd.DataFrame(

{

"OR": results_logit.params * increment,

"Lower CI": results_logit.conf_int()[0]* increment,

"Upper CI": results_logit.conf_int()[1]* increment,

}

)

odds_ratios = np.exp(odds_ratios)

print(odds_ratios)

OR Lower CI Upper CI

Intercept 0.000000 0.000000 0.000000

annual_inc 0.948297 0.937414 0.959307

We can read this number as “Increasing income by $10,000 reduces the odds of default by 1-0.948, or 0.052 (5.2%).”

We can also do marginal probabilities. I’ll use the eyex method which tells us: If annual income increases by 1% from the mean value, what is the percentage change in the probability of default?

p_marg_effect = results_logit.get_margeff(at='mean', method="eyex")

p_marg_effect.summary()

| Dep. Variable: | loan_status |

|---|---|

| Method: | eyex |

| At: | mean |

| d(lny)/d(lnx) | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| annual_inc | -0.3200 | 0.036 | -8.976 | 0.000 | -0.390 | -0.250 |

If annual income, starting at the mean value, increases by 1%, then the probability of default drops by 0.32%.

Combining variables in a logit#

Let’s look at both annual income and renting together. It’s good to get a feel for how to deal with both discrete and continuous variables.

I’m going to use the C categorical method and specify the “treatment”, or omitted, indicator. This is instead of using my dummy variables that I created above. I just want to show you the different ways of doing the same thing.

results_logit = smf.logit("loan_status ~ loan_amnt + int_rate + emp_length + annual_inc + age + C(home_ownership, Treatment('MORTGAGE')) + C(grade, Treatment('A'))", data = loans).fit()

print(results_logit.summary())

Optimization terminated successfully.

Current function value: 0.330446

Iterations 7

Logit Regression Results

==============================================================================

Dep. Variable: loan_status No. Observations: 25570

Model: Logit Df Residuals: 25555

Method: MLE Df Model: 14

Date: Wed, 11 Mar 2026 Pseudo R-squ.: 0.04168

Time: 15:04:42 Log-Likelihood: -8449.5

converged: True LL-Null: -8817.0

Covariance Type: nonrobust LLR p-value: 8.432e-148

=====================================================================================================================

coef std err z P>|z| [0.025 0.975]

---------------------------------------------------------------------------------------------------------------------

Intercept -2.9530 0.188 -15.741 0.000 -3.321 -2.585

C(home_ownership, Treatment('MORTGAGE'))[T.OTHER] 0.5544 0.286 1.942 0.052 -0.005 1.114

C(home_ownership, Treatment('MORTGAGE'))[T.OWN] -0.0831 0.083 -0.998 0.318 -0.246 0.080

C(home_ownership, Treatment('MORTGAGE'))[T.RENT] -0.0192 0.046 -0.413 0.679 -0.110 0.072

C(grade, Treatment('A'))[T.B] 0.3506 0.094 3.717 0.000 0.166 0.536

C(grade, Treatment('A'))[T.C] 0.5076 0.137 3.703 0.000 0.239 0.776

C(grade, Treatment('A'))[T.D] 0.6084 0.174 3.494 0.000 0.267 0.950

C(grade, Treatment('A'))[T.E] 0.6788 0.218 3.110 0.002 0.251 1.107

C(grade, Treatment('A'))[T.F] 1.0340 0.285 3.625 0.000 0.475 1.593

C(grade, Treatment('A'))[T.G] 1.2744 0.392 3.255 0.001 0.507 2.042

loan_amnt -1.583e-06 3.62e-06 -0.437 0.662 -8.68e-06 5.52e-06

int_rate 0.0873 0.020 4.348 0.000 0.048 0.127

emp_length 0.0069 0.003 2.176 0.030 0.001 0.013

annual_inc -5.82e-06 6.85e-07 -8.498 0.000 -7.16e-06 -4.48e-06

age -0.0060 0.003 -1.748 0.080 -0.013 0.001

=====================================================================================================================

Interpretation is similar. With all of the other variables included, renting doesn’t seem to matter much for the probability of default vs. having a mortgage, since that coefficient is not significant. Remember, having a mortgage is the omitted indicator, so everything is relative to that. Notice how as you move down in loan grade that the probability of default increases, relative to being in the top category, “A”, which was the omitted indicator. Annual income is again very significant and negative.

p_marg_effect = results_logit.get_margeff(at='overall', method="dydx")

p_marg_effect.summary()

| Dep. Variable: | loan_status |

|---|---|

| Method: | dydx |

| At: | overall |

| dy/dx | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| C(home_ownership, Treatment('MORTGAGE'))[T.OTHER] | 0.0523 | 0.027 | 1.942 | 0.052 | -0.000 | 0.105 |

| C(home_ownership, Treatment('MORTGAGE'))[T.OWN] | -0.0078 | 0.008 | -0.998 | 0.318 | -0.023 | 0.008 |

| C(home_ownership, Treatment('MORTGAGE'))[T.RENT] | -0.0018 | 0.004 | -0.413 | 0.679 | -0.010 | 0.007 |

| C(grade, Treatment('A'))[T.B] | 0.0331 | 0.009 | 3.713 | 0.000 | 0.016 | 0.051 |

| C(grade, Treatment('A'))[T.C] | 0.0479 | 0.013 | 3.700 | 0.000 | 0.023 | 0.073 |

| C(grade, Treatment('A'))[T.D] | 0.0574 | 0.016 | 3.492 | 0.000 | 0.025 | 0.090 |

| C(grade, Treatment('A'))[T.E] | 0.0641 | 0.021 | 3.109 | 0.002 | 0.024 | 0.104 |

| C(grade, Treatment('A'))[T.F] | 0.0976 | 0.027 | 3.625 | 0.000 | 0.045 | 0.150 |

| C(grade, Treatment('A'))[T.G] | 0.1203 | 0.037 | 3.255 | 0.001 | 0.048 | 0.193 |

| loan_amnt | -1.494e-07 | 3.42e-07 | -0.437 | 0.662 | -8.19e-07 | 5.21e-07 |

| int_rate | 0.0082 | 0.002 | 4.347 | 0.000 | 0.005 | 0.012 |

| emp_length | 0.0006 | 0.000 | 2.175 | 0.030 | 6.41e-05 | 0.001 |

| annual_inc | -5.493e-07 | 6.48e-08 | -8.477 | 0.000 | -6.76e-07 | -4.22e-07 |

| age | -0.0006 | 0.000 | -1.748 | 0.081 | -0.001 | 6.87e-05 |

Hull, Chapters 3 and 10. Logit.#

As we’ve seen, logit models are examples of classification models. Chapter 3.9 starts with the logit sigmoid function and how the model works. This is similar to the discussion above. He also notes that you can use our ideas from Ridge and Lasso models with a logit.

Chapter 3.10 talks about class imbalance. This comes up when the even that we are trying to predict is rare. This is often the case - many diseases are rare, credit default is rare. Your unconditional probability is going to be something like 99.9% of the time you don’t have the disease or that the credit card holder doesn’t default. We’re trying to use machine learning tools to see if we can improve on that.

Let’s bring in the data that Hull uses in the text. We’ll give them each some actual column names look at each data set.

The data has four features. We are trying to predict loan_status.

The data has already been split into training set, validation set, and test set. There are 7000 instances of the training set, 3000 instances of the validation set and 2290 instances of the test set. The four features have been labeled as: home ownership, income, dti and fico.

train = pd.read_excel('https://raw.githubusercontent.com/aaiken1/fin-data-analysis-python/main/data/lendingclub_traindata.xlsx')

validation=pd.read_excel('https://raw.githubusercontent.com/aaiken1/fin-data-analysis-python/main/data/lendingclub_valdata.xlsx')

test = pd.read_excel('https://raw.githubusercontent.com/aaiken1/fin-data-analysis-python/main/data/lendingclub_testdata.xlsx')

# 1 = good, 0 = default

#give column names

cols = ['home_ownership', 'income', 'dti', 'fico', 'loan_status']

train.columns = validation.columns = test.columns = cols

train.head()

| home_ownership | income | dti | fico | loan_status | |

|---|---|---|---|---|---|

| 0 | 1 | 44304.0 | 18.47 | 690 | 0 |

| 1 | 0 | 50000.0 | 29.62 | 735 | 1 |

| 2 | 0 | 64400.0 | 16.68 | 675 | 1 |

| 3 | 0 | 38500.0 | 33.73 | 660 | 0 |

| 4 | 1 | 118000.0 | 26.66 | 665 | 1 |

validation.head()

| home_ownership | income | dti | fico | loan_status | |

|---|---|---|---|---|---|

| 0 | 0 | 25000.0 | 27.60 | 660 | 0 |

| 1 | 0 | 50000.0 | 21.51 | 715 | 1 |

| 2 | 1 | 100000.0 | 8.14 | 770 | 1 |

| 3 | 0 | 75000.0 | 1.76 | 685 | 0 |

| 4 | 1 | 78000.0 | 16.11 | 680 | 1 |

test.head()

| home_ownership | income | dti | fico | loan_status | |

|---|---|---|---|---|---|

| 0 | 1 | 52400.0 | 24.64 | 665 | 1 |

| 1 | 1 | 150000.0 | 17.04 | 785 | 1 |

| 2 | 1 | 100000.0 | 20.92 | 710 | 1 |

| 3 | 0 | 97000.0 | 13.11 | 705 | 1 |

| 4 | 1 | 100000.0 | 24.08 | 685 | 0 |

The target is the value we are trying to predict. These sklearn methods like to store the X and y variables separately.

We are also going to scale our X variables.

Note that we don’t scale the 1/0 y variables here. These are classifier models. Your target is either a 1 or a 0. Our model output is going to be a predicted probability that the target is a 1 or a 0.

# remove target column to create feature only dataset

X_train = train.drop('loan_status', 1)

X_val=validation.drop('loan_status', 1)

X_test = test.drop('loan_status', 1)

# Scale data using the mean and standard deviation of the training set.

# This is not necessary for the simple logistic regression we will do here

# but should be done if L1 or L2 regrularization is carried out

X_test=(X_test-X_train.mean())/X_train.std()

X_val=(X_val-X_train.mean())/X_train.std()

X_train=(X_train-X_train.mean())/X_train.std()

# store target column as y-variables

y_train = train['loan_status']

y_val=validation['loan_status']

y_test = test['loan_status']

---------------------------------------------------------------------------

TypeError Traceback (most recent call last)

Cell In[36], line 2

1 # remove target column to create feature only dataset

----> 2 X_train = train.drop('loan_status', 1)

3 X_val=validation.drop('loan_status', 1)

4 X_test = test.drop('loan_status', 1)

TypeError: DataFrame.drop() takes from 1 to 2 positional arguments but 3 were given

X_train.head()

| home_ownership | income | dti | fico | |

|---|---|---|---|---|

| 0 | 0.809651 | -0.556232 | 0.053102 | -0.163701 |

| 1 | -1.234923 | -0.451393 | 1.307386 | 1.262539 |

| 2 | -1.234923 | -0.186349 | -0.148259 | -0.639114 |

| 3 | -1.234923 | -0.663060 | 1.769728 | -1.114527 |

| 4 | 0.809651 | 0.800204 | 0.974410 | -0.956056 |

X_val.head()

| home_ownership | income | dti | fico | |

|---|---|---|---|---|

| 0 | -1.234923 | -0.911538 | 1.080153 | -1.114527 |

| 1 | -1.234923 | -0.451393 | 0.395077 | 0.628655 |

| 2 | 0.809651 | 0.468899 | -1.108940 | 2.371837 |

| 3 | -1.234923 | 0.008753 | -1.826638 | -0.322172 |

| 4 | 0.809651 | 0.063971 | -0.212379 | -0.480643 |

X_test.head()

| home_ownership | income | dti | fico | |

|---|---|---|---|---|

| 0 | 0.809651 | -0.407219 | 0.747177 | -0.956056 |

| 1 | 0.809651 | 1.389190 | -0.107762 | 2.847250 |

| 2 | 0.809651 | 0.468899 | 0.328707 | 0.470184 |

| 3 | -1.234923 | 0.413681 | -0.549855 | 0.311713 |

| 4 | 0.809651 | 0.468899 | 0.684181 | -0.322172 |

Let’s do some simple counts and percentages first. What percent of our training data have a “good” loan status? What percent are in default? I used some fancier methods above to do these percentages.

freq = y_train.value_counts() # count frequency of different classes in training swet

freq/sum(freq)*100 # get percentage of above

1 79.171429

0 20.828571

Name: loan_status, dtype: float64

Let’s run the logit. We’ll create the logit object and then fit the model. The logit model object has a variety of options that we could choose for it. We’ll print the intercept and the coefficients from the fitted model.

The penalty option lets you choose regular logit, Ridge, Lasso, or Elasticnet by setting the type of L1 or L2 penalty used. See the sklearn manual for more.

#Create an ionstance of logisticregression named lgstc_reg

lgstc_reg = LogisticRegression(penalty = None, solver="newton-cg")

# Fit logististic regression to training set

lgstc_reg.fit(X_train, y_train) # fit training data on logistic regression

print(lgstc_reg.intercept_, lgstc_reg.coef_)

[1.41622043] [[ 0.14529381 0.03361951 -0.32404237 0.363174 ]]

# y_train_pred, y_val_pred, and y_test_pred are the predicted probabilities for the training set

# validation set and test set using the fitted logistic regression model

y_train_pred = lgstc_reg.predict_proba(X_train)

y_val_pred = lgstc_reg.predict_proba(X_val)

y_test_pred = lgstc_reg.predict_proba(X_test)

# Calculate maximum likelihood for training set, validation set, and test set

mle_vector_train = np.log(np.where(y_train == 1, y_train_pred[:,1], y_train_pred[:,0]))

mle_vector_val = np.log(np.where(y_val == 1, y_val_pred[:,1], y_val_pred[:,0]))

mle_vector_test = np.log(np.where(y_test == 1, y_test_pred[:,1], y_test_pred[:,0]))

# Calculate cost functions from maximum likelihoods

cost_function_training = np.negative(np.sum(mle_vector_train)/len(y_train))

cost_function_val = np.negative(np.sum(mle_vector_val)/len(y_val))

cost_function_test = np.negative(np.sum(mle_vector_test)/len(y_test))

print('cost function training set =', cost_function_training)

print('cost function validation set =', cost_function_val)

print('cost function test set =', cost_function_test)

cost function training set = 0.4911114356066864

cost function validation set = 0.48607087962794676

cost function test set = 0.4846698447947508

What is lgstc_reg.predict_proba returning? Let’s ask Claude GPT:

In scikit-learn, when you call lgstc_reg.predict_proba() on a trained logistic regression model (lgstc_reg), it returns the predicted probabilities of the target classes for the input samples.

Specifically, if you have a binary logistic regression model, lgstc_reg.predict_proba(X) will return an array of shape (n_samples, 2), where n_samples is the number of input samples in X. The two columns represent the probability of the negative class (column 0) and the probability of the positive class (column 1) for each input sample.

For example, if you have a binary logistic regression model for predicting whether an email is spam or not, and you call

probabilities = lgstc_reg.predict_proba(X_test), the probabilities array will have two columns, where the first column represents the probability of the email being non-spam (class 0), and the second column represents the probability of the email being spam (class 1).

We can see that below. The numbers in each row sum to 1.

y_test_pred[:5]

array([[0.28275519, 0.71724481],

[0.0660181 , 0.9339819 ],

[0.16605263, 0.83394737],

[0.17623257, 0.82376743],

[0.22953939, 0.77046061]])

I’m going through this because we need to know the shape of this data and what’s in it in order to use it. Let’s keep just the probability that a loan is in default. That’s the second column.

y_test_pred = y_test_pred[:,1]

y_test_pred[:5]

array([0.71724481, 0.9339819 , 0.83394737, 0.82376743, 0.77046061])

Compare this to the data structure for our actual y test values.

y_test[:5]

0 1

1 1

2 1

3 1

4 0

Name: loan_status, dtype: int64

Let’s create a confusion matrix. These help us determine how good a job our model did. From the Hull text:

The confusion matrix itself is not confusing but the terminology that accompanies it can be. The four elements of the confusion matrix are defined as follows:

True Positive (TP): Both prediction and outcome are positive False Negative (FN): Prediction is negative, but outcome is positive False Positive (FP): Prediction is positive and outcome is negative True Negative (TN): Prediction is negative and outcome is negative

To do this, we need to pick a threshold value. This is the value where, if the predicted probability is greater, then we say we are predicting a 1, or that the outcome is true.

# Set a threshold to binarize the predicted probabilities

threshold = 0.7

y_pred_binary = np.where(y_test_pred >= threshold, 1, 0)

y_pred_binary[:5]

array([1, 1, 1, 1, 1])

The confusion matrix method comes from sklearn. The ravel() method is useful when you need to convert a multi-dimensional array into a 1D array, for example, when passing the array to a function or algorithm that expects a 1D array as input.

# Calculate the confusion matrix

tn, fp, fn, tp = confusion_matrix(y_test, y_pred_binary).ravel()

# Print the confusion matrix

print("Confusion Matrix:")

print(f"True Negatives: {tn}")

print(f"False Positives: {fp}")

print(f"False Negatives: {fn}")

print(f"True Positives: {tp}")

Confusion Matrix:

True Negatives: 116

False Positives: 361

False Negatives: 176

True Positives: 1637

We can normalize the counts using rows, columns, or all the data, like we did above. This turns the output into fractions.

# Calculate the confusion matrix

tn, fp, fn, tp = confusion_matrix(y_test, y_pred_binary, normalize="all").ravel()

# Print the confusion matrix

print("Confusion Matrix:")

print(f"True Negatives: {tn}")

print(f"False Positives: {fp}")

print(f"False Negatives: {fn}")

print(f"True Positives: {tp}")

Confusion Matrix:

True Negatives: 0.050655021834061134

False Positives: 0.15764192139737992

False Negatives: 0.07685589519650655

True Positives: 0.7148471615720524

By using “all”, this normalizes across all of the data. So, 72.48% of our data gets correctly categorized as true positives. 5.06% are true negatives. The rest are misclassified as either false positives or false negatives.

Where do you set the threshold? An analyst must decide on a criterion for predicting whether loan will be good or default. This involves specifying a threshold By default this threshold is set to 0.5, i.e., loans are separated into good and bad categories according to whether the probability of no default is greater or less than 0.5. However this does not work well for an imbalanced data set such as this. It would predict that all loans are good!

Here’s some code from the text that iterates over different thresholds. I was using 0.70, or 70%, above.

THRESHOLD = [.70, .75, .80, .85]

# Create dataframe to store resultd

results = pd.DataFrame(columns=["THRESHOLD", "accuracy", "true pos rate", "true neg rate", "false pos rate", "precision", "f-score"]) # df to store results

# Create threshold row

results['THRESHOLD'] = THRESHOLD

j = 0

# Iterate over the 3 thresholds

for i in THRESHOLD:

#lgstc_reg.fit(X_train, y_train)

# If prob for test set > threshold predict 1

preds = np.where(lgstc_reg.predict_proba(X_test)[:,1] > i, 1, 0)

# create confusion matrix

cm = (confusion_matrix(y_test, preds,labels=[1, 0], sample_weight=None) / len(y_test))*100 # confusion matrix (in percentage)

print('Confusion matrix for threshold =',i)

print(cm)

print(' ')

TP = cm[0][0] # True Positives

FN = cm[0][1] # False Positives

FP = cm[1][0] # True Negatives

TN = cm[1][1] # False Negatives

results.iloc[j,1] = accuracy_score(y_test, preds)

results.iloc[j,2] = recall_score(y_test, preds)

results.iloc[j,3] = TN/(FP+TN) # True negative rate

results.iloc[j,4] = FP/(FP+TN) # False positive rate

results.iloc[j,5] = precision_score(y_test, preds)

results.iloc[j,6] = f1_score(y_test, preds)

j += 1

print('ALL METRICS')

print( results.T)

Confusion matrix for threshold = 0.7

[[71.48471616 7.68558952]

[15.76419214 5.06550218]]

Confusion matrix for threshold = 0.75

[[60.82969432 18.34061135]

[11.70305677 9.12663755]]

Confusion matrix for threshold = 0.8

[[42.70742358 36.4628821 ]

[ 6.4628821 14.36681223]]

Confusion matrix for threshold = 0.85

[[22.7510917 56.41921397]

[ 3.01310044 17.81659389]]

ALL METRICS

0 1 2 3

THRESHOLD 0.7 0.75 0.8 0.85

accuracy 0.765502 0.699563 0.570742 0.405677

true pos rate 0.902923 0.76834 0.539437 0.287369

true neg rate 0.243187 0.438155 0.689727 0.855346

false pos rate 0.756813 0.561845 0.310273 0.144654

precision 0.819319 0.838651 0.868561 0.883051

f-score 0.859092 0.801957 0.665532 0.433625

Check out the confusion matrix for 0.70. See how it matches my work above?

The ALL METRICS table shows the trade-off between true positive and true negative rates. My 0.70 threshold captures 90.29% of the true positives, but only 24.32% of the true negatives. The definition for these rates are in the code:

results.iloc[j,3] = TN/(FP+TN)

results.iloc[j,4] = FP/(FP+TN)

The denominator for both rates is False Positives + True Negatives. This sum is total number of actual negative outcomes in the data.

The F-Score focuses on how well positives have been identified. See the text for more.

In particular, pg. 78 has all of these definitions and a discussion of how they are used.

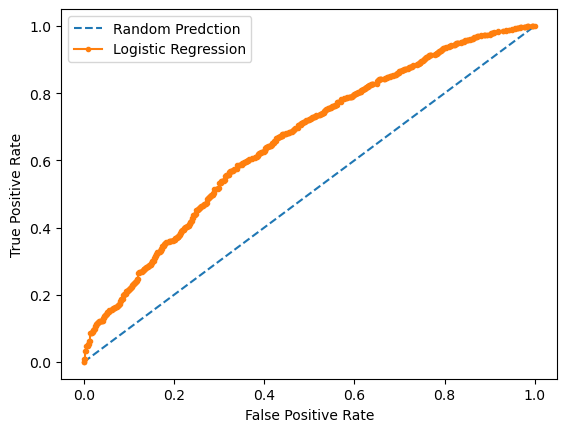

Finally, let’s look at an ROC curve. The ROC curve plots True Positive Rate (y-axis) against the False Positive Rate (x-axis).

The AUC measure, or area under the curve, summarizes the predictive ability of the model. An AUC of 0.5 means that the model is no better than random guessing. This is represented by the dashed line on the graph.

# Calculate the receiver operating curve and the AUC measure

lr_prob=lgstc_reg.predict_proba(X_test)

lr_prob=lr_prob[:, 1]

ns_prob=[0 for _ in range(len(y_test))]

ns_auc=roc_auc_score(y_test, ns_prob)

lr_auc=roc_auc_score(y_test,lr_prob)

print("AUC random predictions =", ns_auc)

print("AUC predictions from logistic regression model =", lr_auc)

ns_fpr,ns_tpr,_=roc_curve(y_test,ns_prob)

lr_fpr,lr_tpr,_=roc_curve(y_test,lr_prob)

plt.plot(ns_fpr,ns_tpr,linestyle='--',label='Random Predction')

plt.plot(lr_fpr,lr_tpr,marker='.',label='Logistic Regression')

plt.xlabel('False Positive Rate')

plt.ylabel('True Positive Rate')

plt.legend()

plt.show()

AUC random predictions = 0.5

AUC predictions from logistic regression model = 0.6577663531841429