seaborn

5.3. seaborn#

We will end our very broad discussion of data visualization with seaborn. seaborn is based on matplotlib, but us “higher-level” (i.e. easier to use) and makes what many consider nicer looking graphs (i.e. many = me). So, why didn’t we start with seaborn? I think it is good to see matplotlib, since it is the most popular way to create figures in Python. But, you should take a look at seaborn as well.

seaborn comes with Anaconda, so there’s nothing to install here. Just add import seaborn as sns to your set-up and you’re ready to go. In my set-up, I’ll set a theme, so that the same theme is used across all of my graphs. I’ll create my returns directly in the stocks DataFrame.

DataCamp has a seaborn tutorial as well.

There’s an example gallery as well.

You can find other examples here.

Finally, I’m going to use the df.var_name convention for pulling out variables from a DataFrame. I find it easier than df['var_name']. I’ll go back and forth in the notes, to get you use to the different styles.

# Set-up

import numpy as np

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

sns.set_theme(style="white")

# Include this to have plots show up in your Jupyter notebook.

%matplotlib inline

# Read in some eod prices

stocks = pd.read_csv('https://raw.githubusercontent.com/aaiken1/fin-data-analysis-python/main/data/tr_eikon_eod_data.csv',

index_col=0, parse_dates=True)

stocks.dropna(inplace=True)

from janitor import clean_names

stocks = clean_names(stocks)

stocks['aapl_ret'] = np.log(stocks.aapl_o / stocks.aapl_o.shift(1))

stocks['msft_ret'] = np.log(stocks.msft_o / stocks.msft_o.shift(1))

stocks.info()

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 2138 entries, 2010-01-04 to 2018-06-29

Data columns (total 14 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 aapl_o 2138 non-null float64

1 msft_o 2138 non-null float64

2 intc_o 2138 non-null float64

3 amzn_o 2138 non-null float64

4 gs_n 2138 non-null float64

5 spy 2138 non-null float64

6 _spx 2138 non-null float64

7 _vix 2138 non-null float64

8 eur= 2138 non-null float64

9 xau= 2138 non-null float64

10 gdx 2138 non-null float64

11 gld 2138 non-null float64

12 aapl_ret 2137 non-null float64

13 msft_ret 2137 non-null float64

dtypes: float64(14)

memory usage: 250.5 KB

Let’s start with our line plot again. We’ll plot just AAPL to start.

sns.lineplot(x=stocks.index, y=stocks.aapl_o)

plt.show();

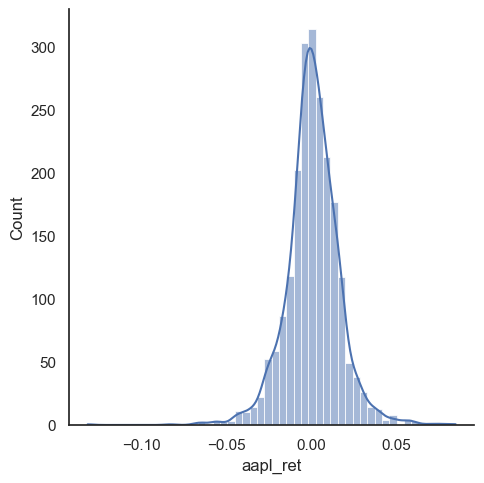

We can also make a distribution, or histogram, as well. I’ll add what’s called the kernel density estimate (kde), which gives the distribution. We’ll do more data work like this when thinking about risk.

sns.displot(stocks.aapl_ret, kde=True, bins=50)

plt.show();

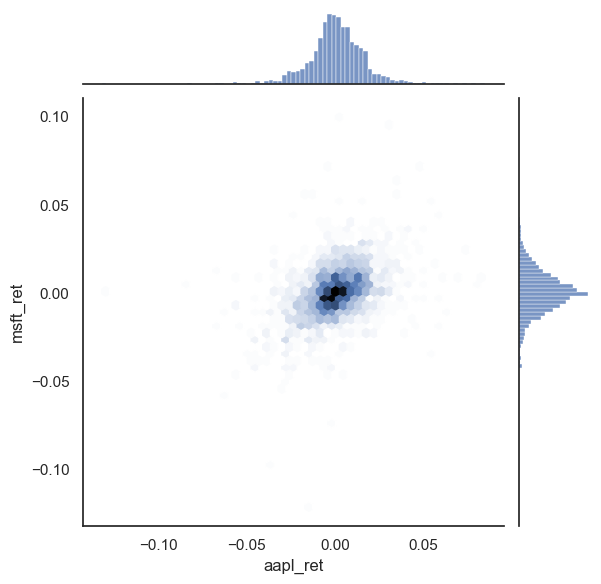

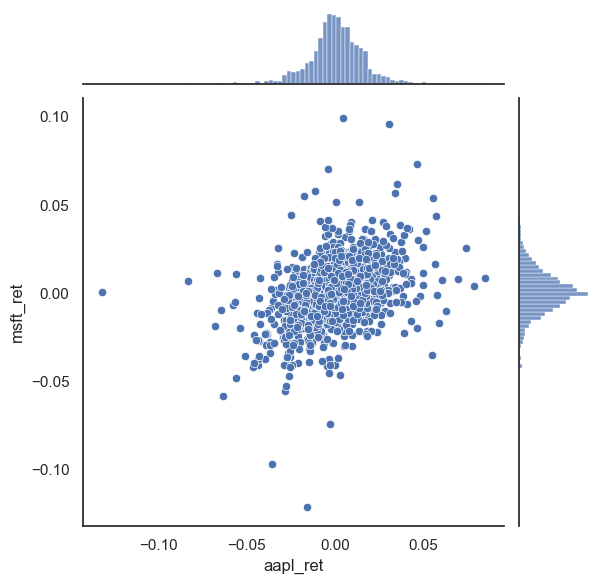

sns.jointplot(x=stocks.aapl_ret, y=stocks.msft_ret)

plt.show();

sns.jointplot(x=stocks.aapl_ret, y=stocks.msft_ret, kind='hex')

plt.show();